1.1. How do I change the number of dependents for withholding, my home address, or bank change for direct deposit of payroll?

Complete a new W-4 form in Rm 117. We will submit it to Human Resources.

This information can also be changed by visiting UAccess Employee and logging in with your UA NetID.

1.2. How do I get direct deposit of my check?

Complete a direct deposit form in Rm 117 and include a bank deposit slip. We will submit it to Human Resources.

This information can also be changed by visiting UAccess Employee and logging in with your UA NetID.

1.3. I want to invite a colleague to work with me. Do I have to make any arrangements through the Department?

Yes, visitors should receive an official letter of invitation from the Department Head, contact Alejandra Gaona [Math 109 (Dept Head Office), (520) 621-2868, agaona@math.arizona.edu].

If you have any plans to pay the visitor for expenses while at the U of A, there are restrictions, particularly if the visitor is a foreign national and then depending on the type of visa and work status he/she holds. Generally speaking, honoraria are not possible and most expenses may only be reimbursed from original receipts up to a limited amount ($600). For more details and up-to-date INS, IRS, and UA policies, contact the Business Office at businessoffice@math.arizona.edu.

If you will need office space, contact Alejandra Gaona [Math 109 (Dept Head Office), (520) 621-2868, agaona@math.arizona.edu].

1.4. If I am taking a leave or sabbatical, what do I need to do?

CONTACT: Please inform the Business Office (Rm 117, 626-7989) in writing of your mailing address, e-mail address, and any other contact information in case we need to get in touch with you while you are away.

OFFICE: Due to the shortage of space and the fact that we hire replacements for persons away for a semester or more, we will need to assign a visitor to your office. You will need to clear the top of your desk, lock your file cabinets, and if possible leave room on a shelf or two. Please inform Alejandra Gaona [Math 109 (Dept Head Office), (520) 621-2868, agaona@math.arizona.edu] of the dates of your absence. Exceptions may be made if you do not plan to leave the University during this time but you still need to contact us. If you return at any time during this period, we may be able to find a temporary office for you if needed.

MAIL: First Class business mail can be forwarded to you in the United States. All other mail will be collected and held for your return. Arrangements should be made for personal mail to be collected and handled externally to the Department. Mail cannot be forwarded to foreign locations. It must be packaged and re-addressed for new postage charges. Please contact the Business Office at businessoffice@math.arizona.edu to make payment arrangements for this and other international shipments.

EXPENSES: If you are traveling on a grant or local funds during this time, please complete a Travel Authorization Form in the Business Office (Rm 117) prior to leaving. On your return, we will process appropriate reimbursements.

1.5. If I am leaving the Department, what is the checkout procedure?

Return your keys to the UA Facilities Key Desk.

Leave your forwarding address, email address, and any other contact

information in case we need to get in touch with you. Only first Class

business mail can be forwarded to you in the United States. Mail cannot

be forwarded to foreign locations. If you have checks pending, inform

the Business Office whether you will pick them up or want them to be

mailed to you.

Return textbooks, all grade books, and final exams from the previous year to Rm 108.

1.6. Is there a notary in the Math Building?

No, but there may be notaries in the College of Science that may

be able to assist you. Please check with head-office@math.arizona.edu

if you require notary service.

1.7. How do I get reimbursed for a book or software I found on the internet?

UA policy does not allow ordering without going through the Purchasing

Dept and processing of the appropriate UA paperwork. Although

reimbursement is possible, the Purchasing Dept can disallow the purchase

and deny the reimbursement. Please bring information about the item you

are interested in to the Business Office (Rm 117) or email your request

to businessoffice@math.arizona.edu for processing.

1.8. How do I find out about submission of a research proposal?

For processing and submission, all paperwork must go through the Department; contact Brooke Valmont (Rm 115) 520-621-6882.

Please notify the Business Office of your plan as soon as possible. However, we would like to start the process a month in advance of the proposal submission deadline.

1.9. Are there travel funds available from the Department?

Not specifically. But if you have a unique circumstance, you may make a

request via email to the Department Head (head-office@math.arizona.edu)

for partial support.

2.1. Summary of Limitations for Expense Reimbursments

Summary of the University's current rates/limitations for expense reimbursements.

Travel Reimbursements: the rates are based on the locations and time of the year. Please refer to these rates before making arrangements for your travels. If a conference has a designated lodging with a higher rate than the approved rate and you need to stay at that lodging, please mark "Designated Lodging" on your travel authorization form to get reimbursed for the designated lodging rate.

- Domestic Lodging and Per Diem Rates: https://gao.az.gov/sites/default/files/2024-01/5095%20Reimbursement%20Rates%20%20240108.pdf

- International Lodging and Per Diem Rates: https://aoprals.state.gov/web920/per_diem.asp

- Personal vehicle mileage reimbursement rate: 65.5¢ per mile

- Airport parking:

- Tucson Airport Parking: the lesser of the actual amount incurred or $5.00 per day base parking charges (plus any taxes or other non-optional fees imposed)

- Phoenix Airport Parking: the lesser of the actual amount incurred or $6.50 per day base parking charges (plus any taxes or other non-optional fees imposed)

- Other locations: no specific rates for parking nationally like for Tucson and Phoenix Airport. If there is a business purpose and the expense is reasonable, it will be reimbursed by Financial Services.

- Please refer to 2.5 Parking Reimbursement Guidelines section for more details on parking reimbursement guidelines including parking lots in Tucson and Phoenix that meet these requirements, and how to register with the Spot Club Card to receive the reduced rate at the suggested parking spots.

Meal Reimbursement: current recommended per person amount is up to $40 including tax and tip.

2.2. Before you Travel

PRIOR TO DEPARTURE: Travel Authorization Request must be completed and submitted to the University Travel System. At least 10 days prior to the start of domestic travel and 30 days in advance of International travel. Official University travel includes, but is not limited to, travel for: conferences, research, sabbatical, partnership collaboration and development. This policy does not apply to personal travel.

The Travel Authorization Request must be submitted for anyone traveling on University business, even if you are not planning to request reimbursement through the UA. Once a travel authorization request is fully approved, you will receive a Travel ID number that can be used for booking travel in the University Booking Tool and requesting reimbursement.

Important information required before initiating a Travel Request:

- Campus Code (MC) Main Campus

- Org Code (0430) Mathematics

- Account Number

- Business Purpose for travel

- Estimated expenses for trip:

- Airline

- Lodging

- Vehicle rental

- Any other expenses (e.g., conference registration, rideshares, parking, etc.)

NOTE: You must create a Profile in the travel system prior to requesting travel for the first time. Travel Profiles are automatically created for employees. Non-Employees (Students/DCCs) must request a profile. (Please allow 24-48 hours for creation of your Travel Profile. Accounts Payable will notify you upon completion.)

Before you submit the travel authorization request, verify that Hanh Do (htdo@math.arizona.edu) is included in the Approval Flow under “More Actions” so the business office is made aware of your travel. However, if Department Head Doug Ulmer name is shown, Hanh does not need to be included in the Approval Flow.

The Mathematics Business Office is open Monday - Friday from 8:00 am -5:00 pm except for holidays observed by the University of Arizona.

Additional Steps Required for International Travel

For International Travel you must also complete the University International Travel Registry as you will be required to provide the International Travel Registry number on the travel authorization request. If you are visiting a country which has a travel warning or is considered high risk locations, please see the "Travel to Higher Risk Locations" below for more details. All steps and information must be submitted 30 days in advance of your international travel or prior to purchasing any airfare for your travel.

Travel to Higher Risk Locations: Certain locations are considered higher risk and the reasons for this designation range from high rates of violent crime to disease outbreaks. For those registering travel to a higher risk location, UA Global Travel will email the traveler asking for Supplemental Travel Information prior to submitting the travel for review by the University's International Travel Safety & Oversight Committee (ITSOC). Additionally, UA Global Travel will reach out to the traveler's University Department to seek confirmation as to whether this travel is deemed "essential".

Helpful Links:

Fund Your Travel

Recommended options by Financial Services to fund business travel:

- Department P-Card: Conference registrations and hotel/lodging for employees only; airfare for employees and non-employees. NOTE: Trips that include personal travel cannot be funded with the PCard.

- Disbursement Voucher: Reimbursement for travel expenses incurred while on travel status. Requires receipts submitted to business office and roughly 2 weeks for review by Financial Services.

- Virtual Credit Card Program: Prepay for employee or non-employee for foreign conference registrations, hotel/lodging, and airfare.

- Travel Advance: A minimum of $250 may be issued by direct deposit up to seven days prior to travel. Please provide receipts for expenses to your business office as soon as possible so they can settle the travel advance. Travel Advances must be settled within 20 business days after the completion of travel.

The traveler can also pay with personal funds and submit a Travel Expense Report after the trip for reimbursement. See Step 6 below: Return from Travel Status.

2.3. International Travel

The Policy for International Travel Safety and Compliance applies to official international travel of all UA Employees (Faculty, Staff, and Graduate students) regardless of the funding source. Official University travel includes, but is not limited to travel for: conferences, research, sabbatical, partnership collaboration and development. This policy does not apply to personal travel.

The policy and procedures facilitate:

-

Information, resources, and guidance to UA travelers to maximize their safety and health while traveling abroad

-

Facilitate immediate access to data on the location of UA international travelers and to communicate rapidly with UA travelers to verify well-being and provide instructions or guidance if needed

-

Evaluate applicability of state and federal regulatory requirements in advance of international travel to provide direction on compliance and avoid potential penalties including imprisonment and severe fines

Compliance is necessary to:

- Receive reimbursement for travel expenses, if eligible

- Be covered by applicable insurance programs during international travel

- Receive UA academic credit for international coursework, if eligible

- Receive available university assistance in the event of an emergency during international travel

- Avoid significant personal fines and potential prison sentences, internationally

- Avoid disciplinary action and/or limitations on future UA travel

- Adhere to related applicable UA, state, and federal policies

Required steps for International Travel (Must be complete at least 30 days prior to departure)

-

Register travel in the University International Travel Registry. To complete registration the Itinerary and Travel Questionnaire must be completed.

- Complete the Travel Authorization Request and provide the International Travel Registry number in the Travel Authorization Request Header.

Each new Travel Authorization generates a new Travel ID number that can be used for booking travel in the University Booking Tool and requesting reimbursement for each trip. Your registry number is available on the International Travel Registry Traveler Home page. After registering you will receive emails indicating changes to the registration status. For most UA international travel these are the only two required steps. The registration status will indicate if any additional steps are required.

*Note: Failure to submit Travel Authorization Request and International Travel Registry prior to departure will require a signed memo from the Department Head granting an exception from compliance.

Travel with Export Control Considerations

The UA Export Control Office will contact you based on your responses to the Questionnaire in the Travel Registry to determine if U.S. government export authorization (license or license exception) is required. Export licenses takes between two and six months) to prepare and receive authorization. Contact the Export Control Office as soon as possible if an export authorization is likely required or if you have questions or concerns about what you plan to take outside the U.S.

Travel under Federal Contract or to a U.S. military installation abroad

If your response to the Questionnaire in the Travel Registry indicates you are traveling as a federal contractor or to a U.S. military installation, Risk Management Services will contact you for further information necessary to obtain Defense Base Act (DBA) insurance. Allow at least thirty days to obtain federally mandated DBA insurance.

FINAL STEP: Prior to departure

- Check the travel registration status to confirm that travel is approved.

- If the status is not approved, determine the remaining required actions. If you have any questions about your status or the needed actions, contact the International Travel Team.

We understand this is an adjustment and strive to support travelers and administrative staff with straightforward and effective processes. We appreciate campus assistance to assure that UA international travel is safe and federally compliant. Please contact us with questions, feedback, or requests for further information, trainings, or presentations.

UA International Travel Team

Please contact Kay Ellis, Director of Export Control Compliance, with questions about federal export control regulations.

Please contact Laura Provencher, International Risk Analyst with questions about travel to Travel Warning destinations, the review process, or health and safety of international travel.

Please contact Steve Holland, Assistant Vice President for Risk Management Services with questions about insurance.

Please contact Tammy Strom, FSO Assistant Director-Operations with questions about University financial services.

For any other questions about travel, please email the UA International Travel Team listserv.

2.4. Submit New Travel Authorization

This guide will instruct travelers on how to use the new Travel System and request reimbursement.

Business Travel Start to Finish

- Confirming Your Travel Profile

- Request Approval/ Fund Your Travel (submit Travel Authorization)

- Book Your Travel

- Take Your Trip (Travel Status)

- Return From Trip

Confirming Your Travel profile

Both Employees and Non-Employees must confirm their Travel Profile following a first-time login.

The system will import the employee’s profile, however, to book travel, there are a few pieces of information that need to be completed before using the Travel Request and Booking Tool:

- Middle Name: Confirm your Legal Name, including your middle name if you have one. Employees: contact Human Resources if you need to update your name on record.

- Email: A code will be sent to verify your Email address.

- Mobile Phone Number: Enter your Mobile phone number (use for Home/Office phone as well).

- TSA Secure Flight information: Please note that this information is required to match the government issued ID the individual will be using to travel.

Travelers are welcome to fill out additional fields such as frequent flyer program information and travel preferences. You can also include a credit card to your profile for booking travel, but it is not needed to process a travel auth request. A credit card is only required in your profile if you are using the booking tool in the travel system.

Helpful Links:

Edge Learning: Getting Started with Travel System

Request Approval for Travel

Once your profile is ready, you can start submitting travel authorization requests. Travel authorization requests are required for any current Employee, Student, or Designated Campus Colleagues (DCC) traveling on behalf of the University of Arizona. Before you can submit the travel authorization, you must ensure that:

- The travel has a legitimate Business Purpose; supports the mission of the University.

- Funds are available for expenses.

The following exceptions must be documented on all travel requests prior to authorization:

- Long term travel status (more than 30 days).

- Personal time taken in combination with business travel.

- Use of airfare other than coach/economy.

- Use of private, chartered, or rented aircraft or rented motor vehicle.

- Vehicle taken out of state (private, rented, or state-owned).

- Lodging in excess of established policy limits; non-designated/unaffiliated conference lodging.

International Travel: The International Travel Registry Number is required for all international travel and it must be included in your travel authorization request. More information about international travel can be found below.

Helpful Links:

Expected Expenses:

After you finish the travel authorization request header, the travel system will ask you to list all anticipated expenses for your trip before the request can be submitted. This includes Airfare, Lodging, mileage, PerDiem, & any other expected travel expenses. If you are not anticipating needing any funding from the University, you must include an expense equal to zero in your request so it can be submitted. The travel authorization request cannot be submitted unless one expense is listed so please include “other travel Expenses” equal to zero if you are traveling without funding from UA.

Including A "User-Added Approver":

Before your travel authorization is ready to be submitted, it is important to Include Hanh Do as a "User-Added Approver" so the form is routed to the business office. To add an approver, click on "More Actions" and then "Edit Approval Flow". If you already see Hanh Do or Doug Ulmer's name in either the "Supervisor Approval" or "Budget Approval", then this step can be skipped and your travel authorization is ready to be submitted. If you do not see Hanh or Doug's name, please click on "Add Step" and search for Hanh or Doug in the "User-Added Approver" area and click save. Once you verify the approval flow is complete, you are ready to submit the travel authorization request.

2.5. Travel reimbursement

Travel Expense Reimbursement

Faculty, staff, students and invited visitors or guests may be reimbursed for university-related business travel by the Mathematics Business Office. The reimbursement process begins with completion of the Travel Authorization Form prior to the commencement of the travel. The Travel Authorization form lets the department and university know about the travel details, length of travel and substantiate the availability of funding. The Business Office sends the completed travel authorization form to the Travel Office and this document is later referenced on the travel expense report completed for the individual to be reimbursed. Completion of this form is a mandatory step in the reimbursement process. Failure to submit the Travel Authorization form and International Travel Registry for international travel prior to travel may result in expenses being unable to be reimbursed.

Upon completion of travel, UA policy requires pertinent documentation and receipts to be submitted within ten days of the end of travel. They should be submitted to room 117 of the Mathematics Business Office for processing. The payee will then receive an email within 3 days requesting for them to return to the Business Office to sign their travel expense report. Reimbursement cannot be processed until the travel expense report is signed.

Common components of any travel expense report include airfare, lodging, meals per diem (or restaurant receipts), conference registration, and other transportation items such as train or taxi cab fares, parking and tolls paid. Below are items of information pertinent to each of these components.

Airfare

- Airfare reimbursed is for the most economical and direct route possible.

- When traveling to another city in addition to that of university business, a flight comparison document of the route otherwise taken is required, and the university will reimburse the lesser of the two amounts.

- A flight comparison document is also needed when the traveler is combining personal and business travel. The comparison must reflect the dates that travel would occur without the the additional days for the personal travel.

- If federal funding is being used to support the travel in question, traveler must use airlines in accordance with the Fly America Act, further detail of which can be found at https://www.gsa.gov/policy-regulations/policy/travel-management-policy-overview/fly-america-act

- Disallowed airfare-related expenditures include those for change fees, early-bird check-in, premium seating, trip insurance and food/beverages not included in the airfare.

- Airfare receipt must show the method of payment that was used.

Lodging

- Lodging must be with a commercial establishment, and is subject to the per diem rate for the applicable city, as listed in the Arizona Meals and Lodging Per Diem Index. If the destination city or county is not listed, the reimbursement rate defaults to $107/night plus taxes and fees.

- If lodging was designated by the conference or event, it can be reimbursed at actual cost. Designated lodging must be proven with documentation.

- Lodging/hotel receipts are reviewed for all charges as they relate to meals per diem and conformance to university policy. For example, a restaurant charge might be deducted from a lodging bill if the payee is also being reimbursed on a meals per diem basis.

- Lodging is only allowed if the destination of travel is greater than 35 miles from traveler’s duty post.

- Disallowed lodging-related expenditures include long-distance calls, laundry, gratuities, personal entertainment, resort fees and valet parking.

- Lodging to be reimbursed must show the method of payment that was used.

Meals per diem

- All points related to meals per diem here apply to the traveler only.

- Meals may be reimbursed on a per diem basis subject to the rate for the applicable city, as listed in the Meals and Lodging Per Diem Reference Guide.

- Meals to be reimbursed typically follow from the trip itinerary, down to the times of departure and return. This may result in partial days of per diem in which the daily amount is split between breakfast, lunch and dinner.

- Please note that at an overnight stay is required to be reimbursed on a meals per diem basis, and rates follow the location of the lodging.

- Reimbursement can only be on one basis, per diem or actual receipts; there cannot be a mix or combination of the two methods.

- If a conference, hotel or event provided a meal or meals, those would be reduced from the amount to be reimbursed.

- Payee may certainly elect to be reimbursed for less than the amount allowed, and should communicate this to the business office in such a case.

Other Methods of Transportation

- There are some receipt documents that can be scanned and sent to us as PDF’s, but any other transportation typically found on a paper receipt, such as for a cab fare or parking needs to be mailed in or brought to the business office, as the original receipts for those are required.

- Mileage driven must be documented by a MapQuest or other site, showing most direct route and number of miles; mileage is reimbursed at the rate of $0.655/mile.

- Either mileage or gas receipts must be used as the basis for reimbursement; the two cannot be mixed or combined.

- If driving is elected over flying, both a written justified reason and a flight comparison document must be submitted.

- Employees driving personal vehicles on university business are required to obtain departmental authorization by reviewing and completing the UA personal vehicle form, found here: Personal Vehicle Form. Please return completed form and proof of insurance to the Business Office for approval.

- Personal vehicles driven on U of A business - There is no State coverage for damage to personal vehicles. Vehicle owners are expected to have their own insurance, and the mileage reimbursement rate includes a cost factor for this expense. Liability incurred in a personal vehicle on U of A business is covered by the State, but only on an excess basis. Personal liability insurance must be exhausted to address claims before State coverage applies.

2.6. Parking Reimbursement Guidelines

Travel Expenditures (Parking Policy)

Updated 3/4/24

The University will reimburse parking expenses if it is reasonable and has a valid business purpose. Below are rules and guidelines to ensure your reimbursement complies with state regulations.

Airport Parking Reimbursement Guidelines

- Economy, long-term, off-premises parking serviced by shuttle is to be chosen when available.

- Receipts with details will be required (i.e. Location, Date, Rate).

- In addition to base parking charges, employees will be reimbursed for any taxes or other non-optional fees imposed. However, reservation fees are NOT

- The state will not reimburse upcharges for covered or inside parking.

- Please keep in mind that you may park wherever you find it convenient, but the university will only reimburse based off the following guidelines listed below:

Tucson Airport Parking

For parking at Tucson airport, the employee will only be reimbursed the lesser of the actual amount incurred or five dollars ($5.00) per day Base parking charges.

Parking lots that meet these requirements are:

- Quick Park Quick Shuttle - 6448 and 6550 South Tucson Blvd., Tucson, AZ (520) 294-9000, 24/7 Service.

- Quick Park Quick Shuttle - 6840 and 6920 South Tucson Blvd., Tucson, AZ (520) 294-9000, 24/7 Service.

- Tucson International Airport Parking -- Economy Parking - 3034 E. Corona Rd. Tucson, AZ, 24/7 Service.

Phoenix Airport Parking

If you are departing from Phoenix International, the University will only reimburse the lesser of the actual amount incurred or six dollars and fifty cents ($6.50) per day Base parking charges

- Travelers must present or acquire a Club Spot Card to receive the reduced rates at The Parking Spot South & The ParkingSpot2

- The Parking Spot South - 3025 S. 48th St., Phoenix, AZ (602) 244-8888, 24/7 service

- The ParkingSpot2 - 4040 E. Van Buren St., Phoenix, AZ (602) 286-9212, 24/7 service

Spot Club Card

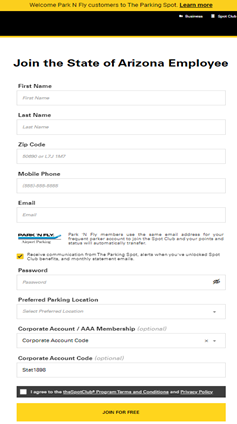

When Parking at the Phoenix Airport, you must register with the Spot Club Card to receive the reduced rate at the parking spots suggested. State employees may receive the club card from the parking lot cashier by showing their Cat Card when leaving the parking lot; the traveler will then be given a spot card and the correct rate. You can also receive a Spot Club Card online by clicking the following link to be directed to creating an account for the Spot Club. (Creating an account is free) https://theparkingspot.com/spot-club/sign-up?gCode=Stat1898

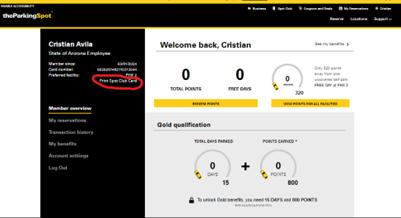

After clicking the link, you will be prompted to create an account and input your information. Below is an example of what the page will look like and the information that is being requested (1). Please, when joining as a state of Arizona employee, do not change the corporate account code and use code Stat1898. After successfully creating an account, you will be directed to your dashboard where you can print your Spot Club Card. To do so, please click on Print Spot Club Card circled in the picture below (2). The spot club card is what must be presented each time at parking locations to receive the reduced rate. An example of a Spot Club Card can be found below (3).

(1). Sign Up for Spot Club Card

(2). Dashboard

(3). Spot Club Card

Parking Elsewhere

The U of A does not have any specific rates for parking nationally like they do for Tucson and Phoenix Airport. If a business purpose is provided for the expense, then financial services will reimburse the expense if it is reasonable.

Example: Parking expenses incurred at a convention center for a conference will be accepted. However, parking to buy dinner for yourself after the conference is not acceptable as it does not further the university’s mission.

Example of an unallowable cost: Valet Parking. If valet is shown on a parking receipt, financial services will only reimburse parking not valet fees. If you are not sure if the parking expense you incurred qualifies for reimbursement, please reach out to your business office with the details.

References

University of Arizona Financial Policies (14.15 Transportation): https://policy.fso.arizona.edu/fsm/1400/1415

State of Arizona Accounting Manual: https://gao.az.gov/sites/default/files/202401/5095%20Reimbursement%20Rates%20%20240108.pdf

2.7. Non-Travel Expense Reimbursements

NOTE: Please see the Travel Expense Reimbursements page for travel-related reimbursements (this section pertains to all other reimbursements).

The

Business office reimburses faculty and staff for expenses incurred that

have a valid university business purpose, have available funding and in

the case of grant funding, are pertinent to the scope of work written

in the grant.

Please

submit receipts for reimbursement to the Business Office in room 117 of

the Mathematics Building. In the event that the Business Office is

unavailable please deliver them to room 108.

Receipts

submitted for reimbursement must be itemized and must indicate the

method of payment made. If paid by a credit card please submit the

credit card slip along with the itemized receipt. If payment is not

shown on the receipt please provide a bank or credit card statement that

verifies payment.

If

you will be using grant funding for reimbursement of the purchase

please email a statement to the Business Office at

businessoffice@math.arizona.edu that provides the relevancy of the

purchase, how it will benefit your grant and how it relates to your

grants scope of work.

You

will be contacted for your signature when the reimbursement report is

completed. Please stop into the business office, again to room 117, to

sign; we will promptly process the electronic version (disbursement

voucher) and send to accounts payable. Please allow sufficient time for

routing and for the appropriate university parties to approve the

reimbursement request.

The following are miscellaneous alerts and reminders that always help!

- Restaurant receipts must be itemized and be accompanied by a list of attendees and the business purpose or agenda for the meal.

- Alcohol

is a disallowed expense and if included on your receipt, will be

deducted along with prorated tax and gratuity in determining a net

reimbursement amount.

5.1. Business Office Guide to Services

Business Office Guide to Services

Building Repair and Maintenance

All

minor requests for maintenance and repair services (including lights,

custodial, telephone), and all billable requests (replacements of white

boards, hanging items on walls, moving furniture, etc.) should be

directed to building@math.arizona.edu

Conference and Workshop Arrangements

Please discuss plans for your workshop with the Head Office https://ua-math-dept.helpspot.com/headoffice/ as early as possible to facilitate arrangements for lodging, food, transportation, space, and participant reimbursement.

Department Budget (including Postage and Telephone)

Postage

for other-than-Department business should be handled personally.

Regarding mailing of letters of reference for graduate students, the

Department will be responsible for up to $8.00 (or 24 letters). Students

are invoiced for the balance over that limit. If faculty prefer, as

advisors, to pay for the amount above the cap, they may make

arrangements through the Business Office.

Federal Express, DHL,

and AirBorne Express are expensive and should be used judiciously.

Please try to plan ahead for all critical mailings. Research-related use

of these services must be reimbursed to the Department.

Telephone

calls to Tucson Information carry a $0.66 charge. Please use the

telephone book whenever possible or plan to reimburse the Department

through the Business Office. Copies of the current book are available in

Room 108. ID numbers are available for direct charge of long-distance

calls. Communication by fax is available in Room 108 under the same

policy as regular long-distance or information calls. Personal calls

should not be made.

General Office Supplies

Regular

office supplies are available in Room 108A. Requests for special items

should be directed to the Business Office (Room 117), businessoffice@math.arizona.edu.

Key Requests

Request for keys, as well as any key card (Room Privilege Card) changes, should be made through the Heads Office (Room 109).

Photocopy Services

Photocopy services are available. Please submit requests here.

Personal copies are allowed at $0.05 per copy and should be reimbursed

to the Department through the Business Office. Due to the large volume

of copying (150,000-200,000 copies per month), please submit all work

with a 24-hour advance notice. (Please see Brooke Valmont [Math 108 (Academic Office), (520) 621-6882, [brooke@math.arizona.edu] for emergencies.)

Proposals and Awards

The

Department provides assistance with requirements from Federal Agencies

for research proposal submission, as well as information on funding

sources, funding availability, and proposal format for Grant and

contract awards administered by University Sponsored Projects Services.

The Business Office provides reports to principal investigators

concerning expenditures, reporting deadlines, terminations and renewals.

Links include:

Purchasing and Travel Processing

Travel

Authorization forms are required for anyone traveling on University

business. These should be submitted to the University's Travel Office

(which the business office will do for you) at least five working days

prior to the departure date, or the date an advance is requested,

whichever is earlier.

A Travel Authorization form is not required

when 1) In-state travel with a University Garage vehicle is the only

expense incurred, 2) In-state travel expenses are less than $100.

(Expenses should be claimed on a Travel Expense Report), or 3)

Out-of-state travel is at no expense to the University and does not

involve the use of a University Garage vehicle.

Travel

Authorization forms which include personal travel in conjunction with

official travel status have certain limitations: 1) For personal time of

not more than seven working days, the University will pay round trip

mileage or lowest airfare (whichever is less) to the farthest point of

official travel. 2) For personal time in excess of seven working days,

the University will pay only one-half the cost of mileage or lowest

airfare to the farthest point of official travel. 3) When personal

travel expenses are included on an excursion or "super saver" airline

package, the University will reimburse for only those portions applying

to University business.

The University's Travel Office enforces

the repayment of travel advances under State of Arizona regulations.

Therefore, settlement of expenses must be within 30 days of return to

avoid deduction of the advance from the traveler's paycheck.

Please provide the following information:

- For the Travel Authorization form and/or Advance:

- Date requested

- Employee ID Number

- Name and Title

- Date of Departure and Return

- Time of Departure and Return

- Destination

- Conference dates (if applicable)

- Concise statement of purpose of trip

- Private vehicle use: estimate total number of miles; reason for use

- Lodging: number of nights at expected rate

- Per

diem allowance for meals and incidentals is $44.00 in-state, out of

state depends on the city (No receipts are required for meals if you

claim per diem)

- Estimate air fare, taxi fares, or rental vehicle

- Estimate miscellaneous registrations fees, airport parking, etc. (Only business-related telephone calls can be reimbursed.)

- Total estimated expense

- Funding source(s)

- Travel Expense Report [Original receipts must be provided for all reimbursable expenses]:

- Airline ticket (passenger coupon) and itinerary

- Hotel

lodging receipts. There are exceptions for some large metropolitan

areas and foreign countries if the hotel is a conference site cited in

the conference program announcement. You may wish to check city rates

before you travel.

- Meals (receipts not necessary if claiming per diem)

- Car rental, gasoline

- Taxis and airport limousines

- Conference registration fees

- Train, bus or municipal transportation tickets

- For conferences, provide a copy of the program.

PROOF OF PAYMENT is required on any documents being submitted for reimbursement.

Space and Office Assignments

The

Department has about 35,000 NASF in the Mathematics Building, the

Mathematics Teaching Lab, and Math East. Assignments are made by Alejandra Gaona (agaona@math.arizona.edu, 520-621-2868). Due to the shortage of space, many offices must be shared.

Please direct all questions regarding office space to the Head Office, 520-621-2868)

Graduate Student Space Assignment Policy

New

Graduate Students will be assigned space where it is available. The

Department will do its best to maintain continuing students in their

current offices; however, due to changes in space requirements, it may

be necessary for continuing students to be reassigned. To receive keys,

see Alejandra Gaona (agaona@math.arizona.edu, 520-621-2868).

Graduate

students are required to apply annually to renew their office

assignment. A memo will be sent in early April of each year. If

you fail to return the form by the date requested, we will assume you no

longer need an office, and we will give your office space to another

student.

Graduate students leaving their office space

must remove their personal belongings and return their keys to the Key

Desk, as soon as possible after the end of the semester or graduation.

Graduate students who fail to return their office keys are responsible

for the cost of re-keying. Belongings remaining in offices will be

stored for 30 days and then given away or destroyed.

Because of

space limitations, we may not be able to provide office space to

non-teaching graduate students or to students with offices in other

areas.

Faculty Absence Space Assignment Policy

Faculty

members who are on sabbatical, or any other type of leave, are expected

to lend their offices during the leave period. Books, papers, and other

professional items may be left in the office during the leave period,

but it is understood that these items should be stored in such a way

that persons assigned to the office during the leave period have

reasonable working space. At a minimum, desktops should be cleared, and

at least two shelves should be made available. This policy applies to

all instructors with an assigned office in space controlled by the

Mathematics Department. Exceptions may be made for faculty members who

will be conducting the major part of their leave activities on campus.

Any exceptions will be handled on an individual basis by the Department

Head.

Visitor Payment and Reimbursement

Information about

visitors should be provided as far in advance of their visit as possible

. This information helps us assign short-term office space, have a key

available, and inform visitors of Departmental policies appropriate to

their length of stay.

Meal reimbursement for entertaining visitors

is limited to $15 each for the host and the guest per engagement,

unless otherwise approved by the Department Head. When requesting

reimbursement, list all persons attending and their affiliation if other

than the Math Department. Original receipts are necessary for all

reimbursable expenses. Costs for Math Department personnel cannot be

paid from Department funds.

Short-term visits (3 days) may need special processing and should be discussed with Alejandra Gaona (agaona@math.arizona.edu, 520-621-2868). Please provide the following:

- Visitor's Name

- Host

- Dates of visit

- Office requirement

- Type of service: ( ) Consultant/speaker; ( ) Candidate; ( ) Other (explain)

- Academic affiliation, telephone number and/or email address

- Expenses to be reimbursed: ( )Airfare; ( ) Hotel; ( ) Meals; ( ) Other (explain)

- Social security number (or passport, visa and I-94 if foreign national)

- Home address (required by the IRS)

5.2. Requisitioning/Ordering

Anyone needing to order office supplies or other items should contact the Business Office https://ua-math-dept.helpspot.com/headoffice/index.php?pg=requestor businessoffice@math.arizona.edu.

Requisitions

are also commonly needed for events, such as for table/chair rentals,

AV equipment, and food. These are typically ordered by the events

coordinator in room 109 https://ua-math-dept.helpspot.com/headoffice/index.php?pg=request.

For such requisitions, it is preferred a meeting is arranged with the

event coordinator and the business office to go over logistical items,

allowable expenditures and budget availability, among other concerns.

5.3. Financial Reporting

This sections applies to those faculty, post-docs and appointed

personnel who have grant activity and/or departmental commitments on

which to review and make financial decisions.

The business office

performs monthly reconciliation of all UA and UA Foundation accounts.

The business office also maintains a database of the departmental

commitments, usage and remaining balances. Reports are generally

communicated to principal investigators and responsible persons on a

monthly basis (in the first week of the following month), and of course,

are available upon request.

Monthly grant reports will include an

overview of the project-to-date activity consisting of columns for the

budget, expenses, encumbrances and remaining balance. This report will

be accompanied by a report of the transactions that occurred in that

month, as a PDF from our University system of record.

Commitment

reports come from an internal database and consist of the starting

balance of said commitment, all transactions that have posted to it and

their respective ending balances.

If upon review of your

applicable reports you have questions or concerns, please visit the

Business Office to review and discuss further.